50-30-20 Budget Rule: A Simple Guide to Financial Health

Managing personal finances can be daunting, but the 50/30/20 budget rule simplifies the process. This rule provides a straightforward framework to allocate your income, helping you achieve financial stability and meet your financial goals. Here’s a detailed guide on how the 50/30/20 budget rule works, with examples to illustrate its application.

Understanding the 50/30/20 Budget Rule

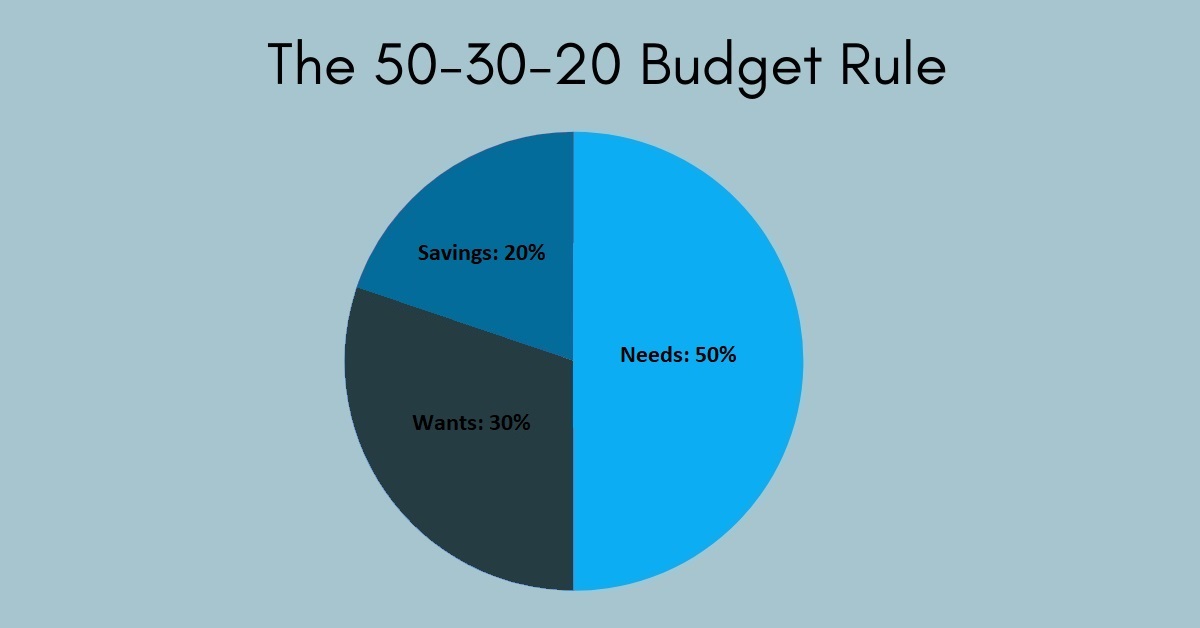

The 50/30/20 budget rule divides your after-tax income into three categories:

- Needs (50%)

- Wants (30%)

- Savings and Debt Repayment (20%)

Let’s break down each category.

1. Needs (50%)

Needs are essential expenses required to live and work. These include:

- Housing (rent or mortgage payments)

- Utilities (electricity, water, heating)

- Transportation (car payments, fuel, public transit)

- Groceries

- Insurance (health, auto, home)

- Minimum loan payments

Example: If your monthly after-tax income is 50,000, 50% allocated to needs would be 25,000. This budget would cover your rent, utilities, groceries, insurance, and transportation costs.

2. Wants (30%)

Wants are non-essential expenses that enhance your lifestyle. These include:

- Dining out and takeout

- Entertainment (movies, concerts, subscriptions)

- Hobbies and leisure activities

- Travel and vacations

- Upgraded appliances or electronics

Example: With a 50,000 monthly income, 30% allocated to wants equals 15,000. This budget allows for dining out, a Netflix subscription, occasional travel, and other leisure activities.

3. Savings and Debt Repayment (20%)

This category focuses on financial growth and security. It includes:

- Emergency fund contributions

- Retirement savings (NPS)

- Investment accounts

- Extra debt payments (beyond minimum payments)

- Saving for significant goals (buying a house, education)

Example: For a 50,000 monthly income, 20% allocated to savings and debt repayment amounts to 10,000. This could be split into 5,000 for retirement savings, 2,500 towards an emergency fund, and 2,500 for paying down debt faster.

Practical Application of the 50/30/20 Rule

Let’s see how the 50/30/20 rule can be applied to a typical monthly budget.

Monthly Income: 50,000

Needs (50% = 25,000)

- Rent: 10,000

- Utilities: 3000

- Groceries: 9000

- Transportation: 2500

- Insurance: 1500

Wants (30% = 15,00)

- Dining Out: 4000

- Entertainment: 1500

- Hobbies: 1500

- Travel Fund: 4000

- Miscellaneous: 4000

Savings and Debt Repayment (20% = 1000)

- Emergency Fund: 2000

- Retirement Savings: 6000

- Extra Loan Payment: 2000

This simplified budget ensures that your essential needs are met, you can enjoy your discretionary spending, and you’re making progress towards financial security.

Adapting the Rule to Your Situation

While the 50/30/20 rule is a helpful guideline, individual circumstances vary. Adjust the percentages to better fit your financial situation if necessary. For instance, if you have high debt, you might allocate more than 20% to debt repayment and reduce spending on wants.

Benefits of the 50/30/20 Budget Rule

- Simplicity: Easy to understand and implement.

- Flexibility: Adaptable to different income levels and financial goals.

- Balance: Ensures a balanced approach to spending, saving, and enjoying life.

- Financial Health: Promotes disciplined saving and debt repayment, enhancing financial security.

Can I Modify the Percentages in the 50/30/20 Rule to Fit My Circumstances?

Yes, we can modify the percentages in the 50/30/20 rule based on your circumstances and priorities. Adjusting the percentages can help you tailor the rule to better suit your financial goals and needs. This is especially relevant for people living in places with a higher cost of living or for people who have higher long-term retirement saving goals.

Conclusion

The 50/30/20 budget rule is a practical and straightforward approach to managing your finances. By dividing your income into needs, wants, and savings/debt repayment, you can achieve a balanced and sustainable financial plan. Whether you’re new to budgeting or seeking a more organized approach, this rule provides a solid foundation for financial health.

Saving is difficult, and life often throws unexpected expenses at us. The 50-30-20 rule provides individuals with a plan for how to manage their after-tax income. If they find that their expenditures on wants are more than 30%, for example, they can find ways to reduce those expenses and direct funds to more important areas, such as emergency money and retirement.

Life should be enjoyed, and living like a Spartan isn’t recommended, but having a plan and sticking to it will allow you to cover your expenses and save for retirement, all while doing the activities that make you happy.

Nice information sir👍

Thank you Raghu!!