How to Invest In Stock Market

As a beginner, Investing in Stock Market can be tricky. Now a days, the investment process has become hassle-free as individuals can allocate their funds to various digital platforms ex: Zerodha, Groww, Angle-one.etc. Stocks are a type of security that gives stockholders a share of ownership in a specified company.

Companies sell shares typically to gain additional money to grow the company this is called the initial public offering (IPO). After the IPO, stockholders can resell shares on the stock market. Stock prices rise or fall and are typically driven by expectations of the corporation’s earnings, or profits.

Investing in stocks is a way to make your money grow over time. By regularly putting money aside to invest, you can see its value multiply over the long term. That’s why it’s important to begin as soon as you start to earn money. The longer your time horizon, the better and you can get benefit of compounding. This article takes you through how much you need, what stocks to choose, and the other basics of investing in stocks you need to get started.

How to Invest in Stock Market

You should keep in mind that there are two types of share markets: primary and secondary share markets.

Investing in the Primary Share Market.

Investments in the primary share market are through an Initial Public Offering (IPO). After a company receives all the applications made for an IPO by investors, the applications are counted, and shares are allotted based on demand and availability. To invest in both primary and secondary markets, you need to have a Demat account that will hold electronic copies of your shares. Additionally, a trading account is also important which will help in buying and selling shares online.

In rare cases, it is also possible for a trader to apply directly from their bank account. IPO application through net banking is made easy via a process that is known as Application Supported by Blocked Amount (ASBA).

As per the ASBA process, if one applies for shares that are worth ₹1 lakh, instead of being sent to the company, these funds will be blocked into their bank account. Once you receive your allotment of shares, the exact amount will then be debited with the balance being released. All applications that are sent to IPOs are required to follow this protocol. Once shares are allotted to traders, they are listed on the stock exchange, and you can begin trading them within one week.

Investing in the Secondary Share Market

Secondary share market investing or trading refers to the regular purchase and sale of shares or stocks. There are a few simple steps to follow before you start investing in the secondary share market.

- Step 1: Open a Demat and trading account. This is the starting point to invest in the secondary market. Both of these accounts should be linked to a pre-existing bank account for a seamless transaction.

- Step 2: Selection of shares. Log into your trading account and choose the shares that you wish to buy. Ensure that you have the requisite amount of funds in your account to purchase those shares.

- Step 3: Select the price point. Decide the price at which you want to buy or sell a share. Wait for the buyer or seller to reciprocate that request.

- Step 4: Complete the transaction. Once the transaction is complete, you receive shares for the stocks that you have respectively purchased.

Ensure that you are mindful of the duration for which you remain invested and the financial goals you wish to achieve through your investments.

Documents required for opening a Demat/Trading Account

To begin investing in the share market, you need to have the following documents:

- PAN Card

- Aadhaar Card

- Name on a cancelled cheque from their active bank account showing IFSC Code, account number, Account holder’s name, and signature.

- Pay slip detailing that the applicant earns a steady income.

- A proof of address that is based on a list of documents that have been accepted by your broker, depository participant, or bank.

- Passport-sized photographs of the applicant.

Things to keep in mind before investing.

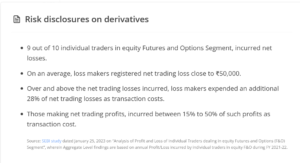

Important Note: Please read blow risks on derivative trading.

Although stock trading isn’t as difficult as it seems, it is possible to be swept away by the world of trading without being rewarded by it in the long term. To prevent this outcome, keep the following points in mind before investing:

Diversify your portfolio.

A diverse portfolio is a healthy portfolio. If a particular asset class dominates your portfolio, it will not offer a steady stream of funds your way when that instrument is going through a low patch. To offset the low periods of one asset class, financial advisors recommend adding alternative asset classes. For instance, equity is often offset with investments in bonds or other debt instruments. This balance in a portfolio can secure one against a period of market crisis.

Understand your investor profile

Your investor profile can reveal the kind of instruments that are best suited to your risk appetite. This allows you to ensure that you are taking on the amount of risk that is best suited to your lifestyle.

Create an investment plan

You can avoid potential pitfalls down the line if you have an investment plan that states the amount of revenue you wish to earn from your investments and the time horizon you potentially need to remain invested to earn that amount.