What is Tax Harvesting and How does it work

Understanding Tax Harvesting

Tax harvesting, often referred to as tax-loss harvesting, is a strategic method employed by investors to minimize their tax liabilities on capital gains. This approach is widely recognized in various parts of the world, including India, where investors look to optimize their tax outcomes while adhering to the regulations stipulated by the Income Tax Department.

This article delves into the intricacies of tax harvesting, explaining its mechanisms, benefits, and application within the Indian context.

What is Tax Harvesting?

Tax harvesting involves selling securities at a loss to offset the capital gains realized from other investments. By doing so, investors can reduce their taxable income, which, in turn, lowers their tax liability. The primary objective is to use the capital losses to neutralize the taxes due on capital gains, thereby optimizing the overall tax outflow.

How Does Tax Harvesting Work in India?

The Income Tax Act, 1961 governs the taxation of capital gains in India. Here’s a step-by-step breakdown of how tax harvesting can be effectively utilized by Indian investors:

- Identifying Capital Gains and Losses:

- Capital gains are categorized into short-term capital gains (STCG) and long-term capital gains (LTCG) based on the holding period of the asset. For equity shares and equity-oriented mutual funds, a holding period of less than 12 months qualifies for STCG, while a holding period of more than 12 months qualifies for LTCG.

- Investors must first identify their capital gains for the financial year. This includes both realized gains from the sale of securities and unrealized gains.

- Realizing Losses:

- To offset these gains, investors can sell securities that are currently at a loss. These losses can be short-term or long-term, depending on the holding period.

- For instance, if an investor has short-term capital gains of INR 1,00,000 and also holds stocks with unrealized short-term losses of INR 50,000, selling these loss-making stocks will realize the losses and bring down the net taxable short-term capital gains to INR 50,000.

- Offsetting Gains with Losses:

- The Income Tax Act allows the set-off of capital losses against capital gains. Short-term capital losses can be set off against both short-term and long-term capital gains, while long-term capital losses can only be set off against long-term capital gains.

- Continuing the previous example, if the investor also has long-term capital gains of INR 30,000, the net taxable capital gains post tax harvesting would be INR 20,000 (short-term capital gains after setting off short-term losses + long-term capital gains).

- Re-investing Proceeds:

- Post the sale of loss-making securities, investors can reinvest the proceeds into similar securities, maintaining their portfolio composition while still benefiting from the tax loss.

- Sell before gains exceed ₹1.25 lakh:

-

- Since long-term capital gains below ₹1.25 lakh are tax-free, investors can monitor their gains and sell the investment before the gains exceed ₹1.25 lakh. For example, you invested ₹5 lakhs in January 2022. In March 2023, your investment value is ₹5.6 lakhs. Now you can sell & book a gain of ₹1,00,000 & pay ₹0 LTCG tax since gains are less than ₹1.25 lakh.

Benefits of Tax Harvesting

- Tax Savings:

- The primary benefit is the reduction in taxable income, leading to significant tax savings.

- Portfolio Rebalancing:

- Tax harvesting provides an opportunity to review and rebalance the investment portfolio, potentially disposing of underperforming assets and reinvesting in more promising opportunities.

- Compounding Benefits:

- By reducing tax liabilities, investors can reinvest the saved amount, thereby enhancing the compounding effect on their investments.

Considerations and Limitations

- Wash Sale Rule:

- Unlike some countries, India does not have a strict wash sale rule that prevents investors from buying back the same or substantially identical security within a short period after selling it for a loss. However, caution is advised to avoid any potential scrutiny from tax authorities.

- Transaction Costs:

- Frequent buying and selling of securities to harvest tax losses can lead to increased transaction costs, including brokerage fees and securities transaction tax (STT).

- Market Timing:

- Investors need to be cautious of market conditions. Selling at a loss to harvest tax benefits might lead to missing out on potential market recoveries.

Let’s delve deeper into the intricacies of tax harvesting in India, explore practical examples, and discuss advanced strategies and considerations.

Deep Dive into Tax Harvesting in India

Detailed Mechanism of Tax Harvesting

- Identification of Capital Assets:

- Short-Term Capital Assets: These include equity shares and equity-oriented mutual funds held for less than 12 months.

- Long-Term Capital Assets: These include equity shares and equity-oriented mutual funds held for more than 12 months.

- Tax Rates:

- Short-Term Capital Gains (STCG) on equity shares and equity-oriented mutual funds are taxed at 20%.

- Long-Term Capital Gains (LTCG) exceeding INR 1.25 lakh in a financial year on equity shares and equity-oriented mutual funds are taxed at 12.5% without the benefit of indexation.

- Loss Set-Off Provisions:

- Short-Term Capital Losses can be set off against both STCG and LTCG.

- Long-Term Capital Losses can only be set off against LTCG.

Practical Examples

Example 1: Offsetting Short-Term Capital Gains

Suppose an investor has the following portfolio:

- Short-term capital gains from stocks: INR 1,50,000

- Long-term capital gains from mutual funds: INR 50,000

The investor also holds some stocks that are currently at a short-term loss of INR 80,000. By selling these loss-making stocks, the investor can:

- Reduce the short-term capital gains by INR 80,000

- Net taxable short-term capital gains = INR 1,50,000 – INR 80,000 = INR 70,000

This reduces the overall tax liability on short-term capital gains.

Example 2: Offsetting Long-Term Capital Gains

Suppose another investor has:

- Long-term capital gains from stocks: INR 2,00,000

- Short-term capital gains from mutual funds: INR 1,00,000

The investor also has some long-term investments that are at a loss of INR 1,50,000. By selling these loss-making investments, the investor can:

- Reduce the long-term capital gains by INR 1,50,000

- Net taxable long-term capital gains = INR 2,00,000 – INR 1,50,000 = INR 50,000

This reduces the tax liability on long-term capital gains.

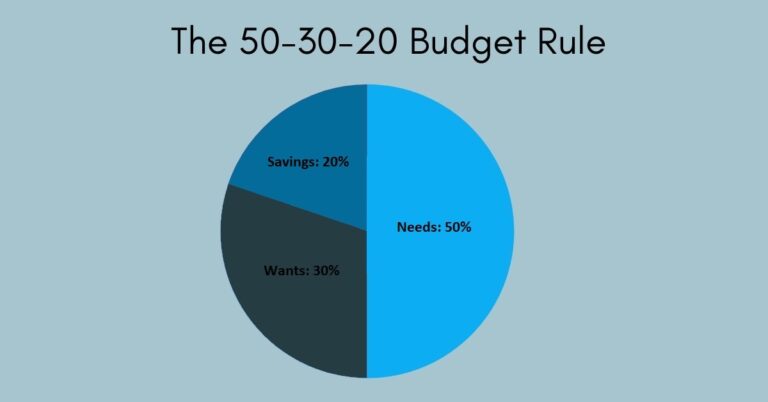

Advanced Strategies for Tax Harvesting

- Tax-Gain Harvesting:

- Apart from harvesting losses, investors can also consider harvesting gains in a low-income year to take advantage of lower tax rates. By selling securities with gains in a low-income year and repurchasing them, investors can reset the cost basis without incurring significant tax liabilities.

- Utilizing Exemptions and Thresholds:

- In India, long-term capital gains up to INR 1.25 lakh are exempt from tax. Investors can strategically sell investments to realize gains up to this limit every financial year, thereby maximizing the tax exemption benefit.

- Timing of Sales:

- Investors should consider the timing of sales carefully. For instance, selling securities towards the end of the financial year can provide better visibility into the overall capital gains and losses for the year, allowing for more precise tax planning.

- Dividend Reinvestment Plans (DRIPs):

- By opting for DRIPs, investors can convert dividend payouts into additional shares, thereby potentially increasing the cost basis and reducing future capital gains.

- Portfolio Re-balancing:

- Regular portfolio re-balancing can naturally create opportunities for tax harvesting. By periodically adjusting the asset allocation, investors can realize losses on underperforming assets and gains on outperforming ones.

Considerations and Risks

- Market Risk:

- Selling investments to harvest losses can expose investors to market risk, especially if there is a significant time gap before reinvesting the proceeds. Market conditions can change rapidly, and the reinvestment may not capture the same potential for growth.

- Behavioral Biases:

- Investors need to be cautious of behavioral biases such as loss aversion and overtrading. The decision to sell should be based on sound financial reasoning rather than an emotional response to temporary market fluctuations.

- Regulatory Compliance:

- While India does not have a strict wash sale rule, investors should ensure that their transactions are compliant with all tax regulations. Keeping detailed records of all transactions is crucial for accurate tax reporting and avoiding any scrutiny from tax authorities.

- Cost Considerations:

- Frequent trading to harvest losses can lead to higher transaction costs, including brokerage fees and taxes like the Securities Transaction Tax (STT). Investors should weigh these costs against the potential tax savings.

Conclusion

Tax harvesting is a powerful tool for investors looking to optimize their tax liabilities in India. By strategically selling loss-making securities to offset capital gains, investors can achieve substantial tax savings while maintaining a balanced and well-performing investment portfolio. However, it requires a careful assessment of market conditions, transaction costs, and regulatory guidelines to maximize its benefits effectively. By considering advanced strategies and potential risks, investors can make informed decisions that enhance their overall financial well-being.

Tax harvesting, when executed correctly, not only provides tax benefits but also encourages a disciplined approach to investment management and portfolio re-balancing, ultimately leading to a more efficient and optimized investment strategy.

Good information

Thank you, Kiran!!